One thing businesses cannot do without is good infrastructure; most especially for those that are into manufacturing. Production processes take up a lot of time and resources and thus rely heavily on constant water and electricity supply, good roads for transportation of goods and trade activities, amongst other essential properties. However, that has been a challenge for many African countries that are underway with industrial and economic developments. Countries like South Africa, Rwanda, Mauritius, Egypt, etc., are currently on the list of Africa’s most developed countries with pooled infrastructures that keep expanding. West African countries like Ghana and Nigeria are also industrializing and progressing with development. That notwithstanding, with all attempts to build back better and sustain economic growth, there is a need to address, foremost, the infrastructure gap and its relationship with manufacturing.

What is infrastructure and why is it so important to a country’s development?

Infrastructure, according to Market Business News, refers to the basic systems and services that a country or organization must have in order to operate effectively. it includes all the physical infrastructure, such as the road and railway networks, utilities, sewage, water, telephone lines, and cell towers, air control towers, bridges, etc., as well as services including law enforcement, emergency services, healthcare, education, etc.

The ability to enable productivity in an economy depends on these critical infrastructures, which demand significant initial investments. The majority of projects are either wholly or heavily supported by the government. Society as we know it would not exist without infrastructure, which includes all the elements our economy needs to run and which we take for granted.

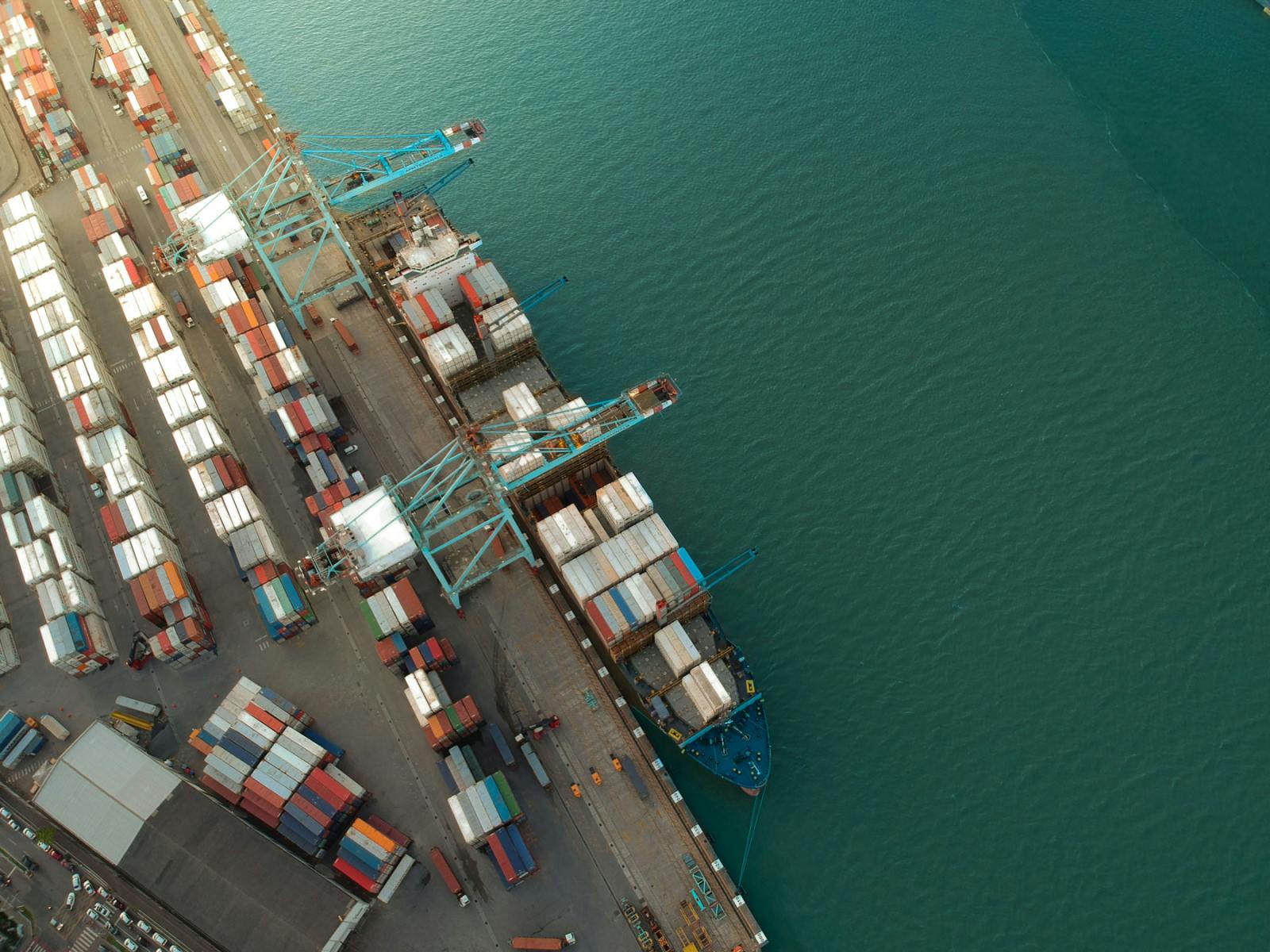

Infrastructure can include highway and railroad systems, tunnels, and bridges, energy-generating facilities like power plants, wind farms, hydroelectric plants, etc., reservoirs and dams, ports, airports, waterways, canals, telephone cables, and cell phone towers, as well as health services like hospitals, clinics, and emergency response systems, and education, including schools, colleges, universities, and other adult education facilities.

Trade is made possible by infrastructure, which also powers enterprises, connects employees to their employment, offers opportunities to underdeveloped populations, and shields the country from an increasingly unpredictable natural environment. Through the implementation of initiatives like bridges, roads, communication, sewage, and power. It also aids in the reduction of poverty in developing nations. Aside from that, effective infrastructure facilitates the movement of information and goods.

Investments in infrastructure have the ability to increase economic potential in the long and short terms. By generating jobs and fostering growth, a significant increase in government spending on labor-intensive infrastructure projects can boost the economy in the short run. Productivity may increase in the medium to long term with better access to related services like electricity, transportation, water, and digital connectivity. Such services boost an economy's potential supply capacity, for instance, by helping to run businesses more effectively.

As a result, having a network of well-developed, well-maintained infrastructure makes it possible for individuals and businesses to invest in industries that rely more heavily on the use of the infrastructure. To put it simply, it may enable businesses to spend in areas they previously were unable to.

Infrastructure Gaps In Africa

Resources abound in Africa, many of which have aided in the growth of several countries around the world. However, a lack of proper infrastructure continues to be a significant barrier to Africa's ability to thrive economically. Meeting the demand for essential infrastructure has been deemed a priority because Africa is considered to be one of the economic centres with the fastest growth rates in the world. The lack of physical infrastructure continues to be one of Sub-Saharan Africa's biggest developmental obstacles. Inadequate transportation, communication, water, and electricity infrastructure hinders greater economic activity, efficiency, and competitiveness. Despite the desire of the world to conduct business with Africa, the continent's underdeveloped infrastructure makes it difficult for foreign companies to enter its markets.

The quality of life is directly impacted by social infrastructure, which includes primary services like water supply, sanitation, sewage disposal, education, and health. Physical infrastructure, which includes transportation, power, and communication, facilitates growth through its backward and forward linkages. Africa won't experience the levels of growth anticipated or needed without this infrastructure. Therefore, if Africa is to realize its enormous economic and developmental potential, infrastructure planning and investment are crucial. Careful creation of a sustainable infrastructure that may help turn the situation around is essential to assisting the continent in realizing its economic potential. The push-pull relationship with commodities has evolved into the driving force for infrastructure development in Africa, despite the fact that infrastructure development is inextricably related to the continent's economic growth and development.

The Way Forward

The development of the economy is significantly aided by infrastructure. After land availability, motorways, industrial zones, convenient commuting, and environmental limitations are almost equally essential justifications for having an established and dependable infrastructure to support manufacturing and other production and/or economic activities. Consider this:

Making wise maintenance and investment choices is the key to building safe and dependable infrastructure. The initiatives to upgrade Africa's infrastructure for the present and the future thus need to be spearheaded by the government. Transport infrastructure, for instance, has an impact on the development of industrial specialization, particularly that of light manufacturing industries, but it is not the primary factor determining the industrial specialization of a region. The demand for infrastructure in Africa must be addressed, and innovation must be a part of the answer. The infrastructure issue can be solved in part by utilizing novel concepts, components, techniques, and tools. Infrastructure improvements have a significant impact on how it reacts to shifts in manufacturing organization and technology.

Again, Infrastructure improvements must be robust and created to function in a changing environment. Infrastructure must endure constant change. In order to support the growth of our economy, our infrastructure must essentially fulfill the following purposes:

· A better transportation system that gets people to their destinations faster and less stressfully, allowing manufacturers to access a wider range of locally based talent and ensuring that they show up to work in better shape.

· Traditional infrastructure positioning made possible by the development of global positioning systems (GPS), which enable quick and continuous determination of precise positions.

· Transporting items as they are moved via the supply chain into manufacturing or the distribution chain to the market.

· Interpersonal interactions that go beyond co-presence.

· The development of activity nodes, each of which depends on its location within the network of activity for success.

In addition, Public-Private partnerships (PPPs) are becoming more and more popular among governments and state agencies as a means of providing efficient and affordable infrastructure and services. Private sectors can aid public sector organizations in a number of ways, including speeding up delivery times, sharing risks, getting more value for their money, and fostering innovation in the delivery of services and the deployment of infrastructure. These alliances enable businesses in the private sector to use their expertise and experience in infrastructure development and operation while also raising money for long-term infrastructure projects. Despite their potential, PPPs are highly complicated policy instruments and must be thoroughly understood before being effectively implemented and managed.

Above all, maximizing the advantages that can be gained from this process depends on the political resolve to make choices quickly and openly. The infrastructure gap, which refers to the amount of investment needed to address fundamental infrastructure demands, is significant and expanding. To maintain and improve important public infrastructure, developing nations must invest 5% of their yearly gross domestic product (GDP) in infrastructure capital projects. Bold strategies and workable solutions, like PPPs, are needed to address this ongoing challenge.

.jpg&w=3840&q=75)